Blog

State of Quantum Industry Innovation – What Patents Tell Us

Published:

- Category: Law

Written by: Elliott J. Mason, III, PhD

QED-C has been tracking patent trends in quantum computing and quantum communications since 2021. This year, we updated the trend with data for 2023 and analyzed the results. We also, for the first time, compare the results of our approach with that of several others.

Findings:

Protection of intellectual property (IP) is core to the development and commercialization of new technologies and quantum technologies are no exception. Even though most patents are never litigated or licensed, they allow early innovators to stake out broad areas of application for their inventions. Ownership of key IP is critical for startups when seeking private investors; it can be of significant value even if the business does not succeed. In addition, patents may eventually be incorporated into standards and be an important source of revenue. Finally, a robust patent portfolio can open cross-licensing opportunities.

This study updates our previous reports[1] with patent data for 2023. Overall, the number of quantum computing and quantum communications patents continues to grow and the entities with the most patents remain relatively consistent.

A patent search can be performed using classification codes or keywords. The International Patent Classification system and the Cooperative Patent Classification system are used by many countries to group inventions according to technical area. Because classification codes are often broadly interpreted, patents that are only peripherally related to the technical area may be included in a classification; this approach can lead to a significant number of “false positives”. In fact, the classification code for quantum computing (G06N) includes a warning that there are also other classes related to quantum computing, but those other classes also include non-quantum subjects. In addition, a patent generally has a long list of codes that are related to its subject matter, some of which don’t represent the main features of the patent. A random sampling of patents that include the G06N quantum computing code reveals that for a significant fraction, the main topic has no clear relationship to quantum computing.

Using a keyword search poses different challenges. If a keyword search is not suitably broad, it can lead to a significant number of “false negatives,” meaning it may miss patents that should have been included. A typical keyword search searches the patent title, abstract, and claims, but the title is often very generic and nondescript, and the abstract may duplicate one of the claims. The claims, which define the legal scope of the invention, typically give a good indication of what the patent is about. However, claims generally avoid jargon, especially in the broadest claims, so many of the keywords may not appear. The language in dependent claims and certain kinds of independent claims (e.g., so-called picture claims) tends to be more specific, which gives more hope for finding keyword matches.

This analysis used a keyword search that was developed in 2021 to provide minimal false positives and false negatives and to allow for comparisons year over year. Custom queries were developed to search for patents related to quantum computing and quantum communications. The information presented is based on the Derwent Innovations Index of worldwide patents since 1963 and includes the following.

Note the figures show data for issued patents according to the year the associated patent application was filed. There is typically a fixed delay of 18 months between a patent application’s effective filing date and its publication date unless the patent was issued sooner than 18 months or had a nonpublication request. However, the period between the effective filing date and the issuance date can vary widely. The data in the figures are plotted by this publication date, which is more closely coupled to when the invention was made than the issuance date. It should be noted that the numbers for recent years are subject to increase in the future as patents are issued from currently pending applications that were published in the years shown in these figures. The PCT data show the number of applications filed by publication year. However, these numbers won’t change because PCT applications are not officially examined and, therefore, are never issued.

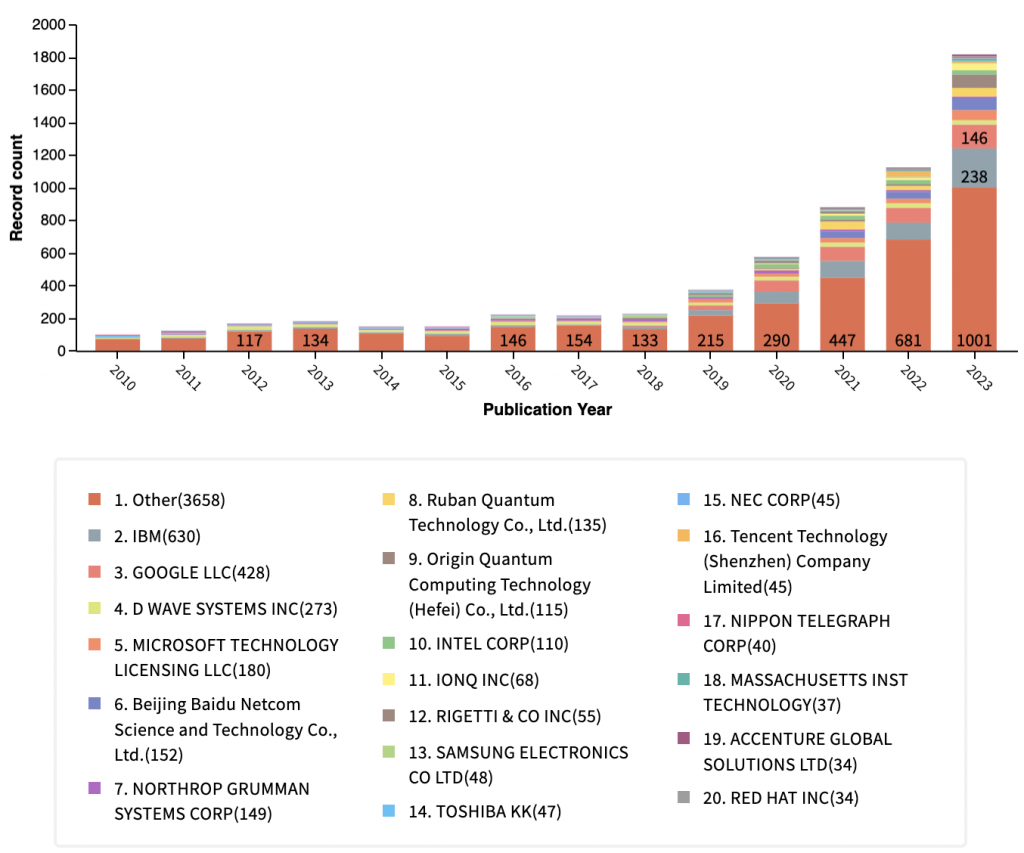

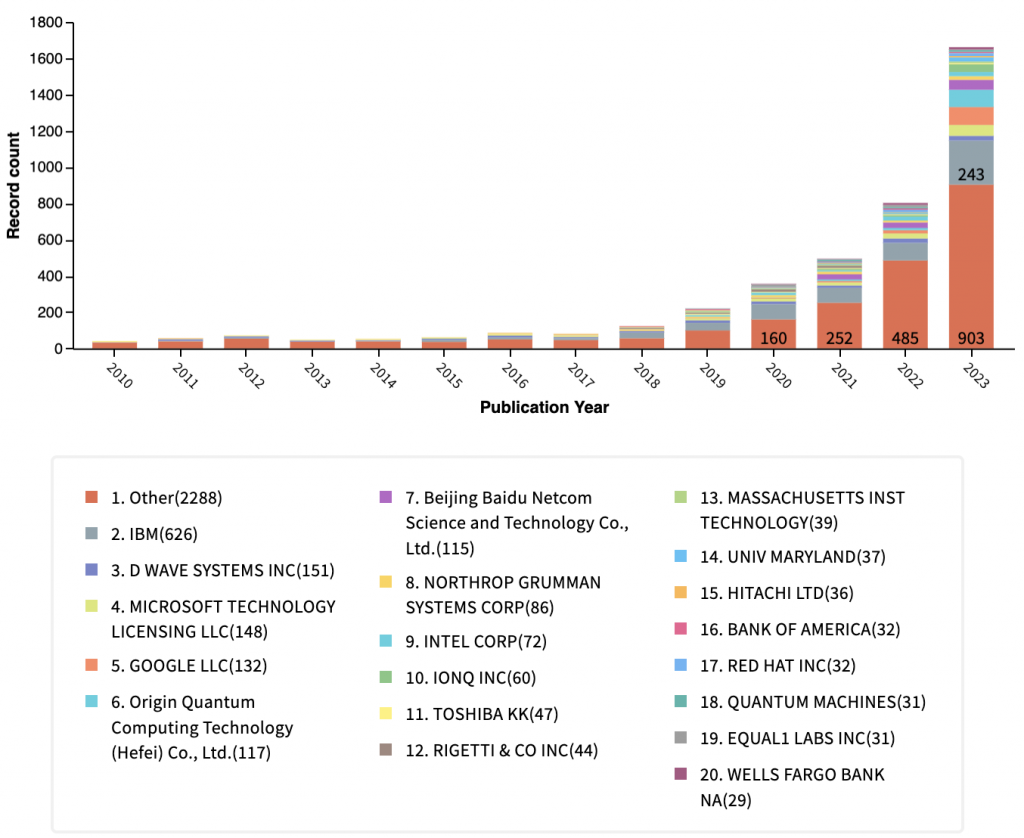

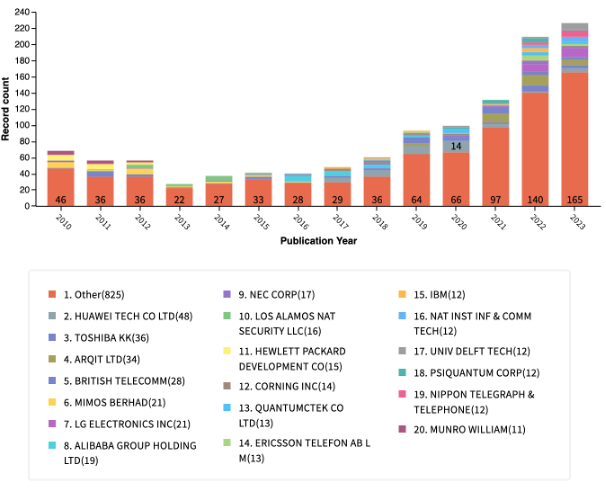

The number of issued quantum computing patents continues to grow year over year (Figure 1). In 2023, the number was 61% percent higher than in 2022. And the average growth was modest between 2010 and 2018; however, since 2019 the average annual rate of growth has been 49%. The acceleration in issued patents may be partly due to the increase in R&D spending in both the public and private sectors. Familiar companies and research institutions are among the top patent owners, which is confirmation that the keyword-searching technique is yielding reasonable results.

Figure 1. Quantum computing patents issued worldwide in 2010 through 2023 by year of publication. The figure on the top shows the 19 patent owners with all others grouped together. The figure on the bottom shows just the top 10 patent owners.

Compared to 2022, the top 3 patent owners are the same, but Microsoft has moved into fourth position and Beijing Baidu Netcom Science and Technology is now in fifth position. Similar to 2022, the “other” fraction is just over half of the total number for 2023.

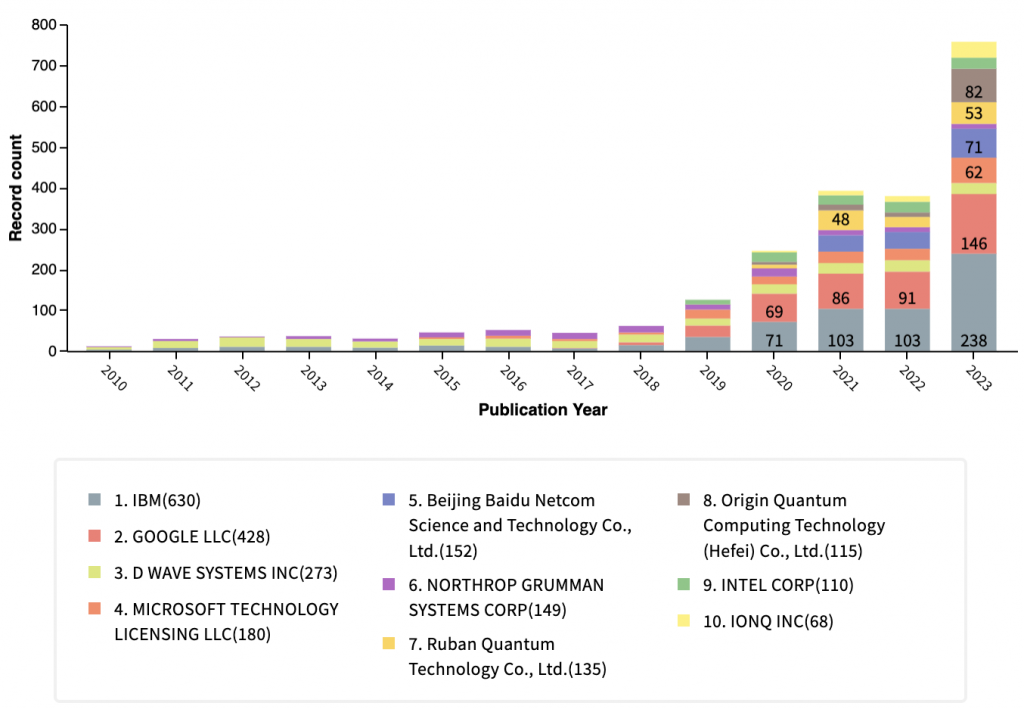

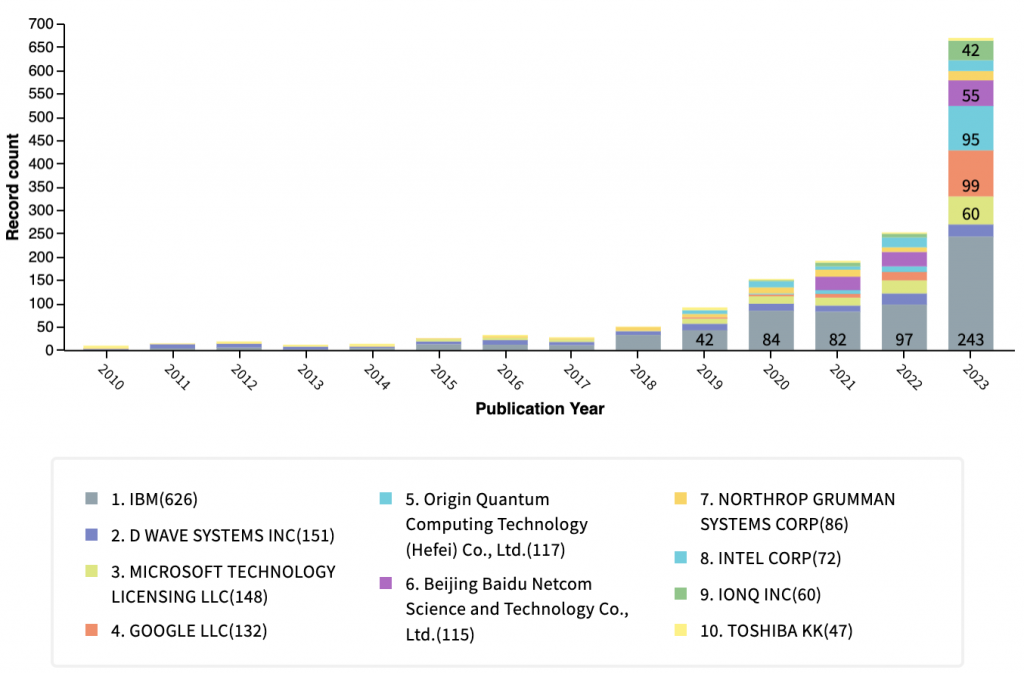

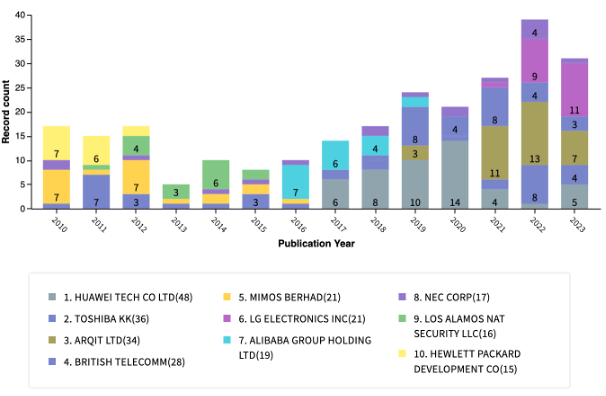

The trend in the number of Patent Cooperation Treaty (PCT) applications related to quantum computing is shown in Figure 2. PCT applications allow patents to be filed in multiple countries and are an indication the invention may be manufactured, sold, and/or used in global markets. The number of PCT applications is also growing steadily, with an average annual increase of 32% over the period 2019 – 2023. However, the number for the top 10 filers has not grown since 2020, which could be an indication of tightening budgets for these larger entities given the expense of filing in multiple countries, especially via the PCT.

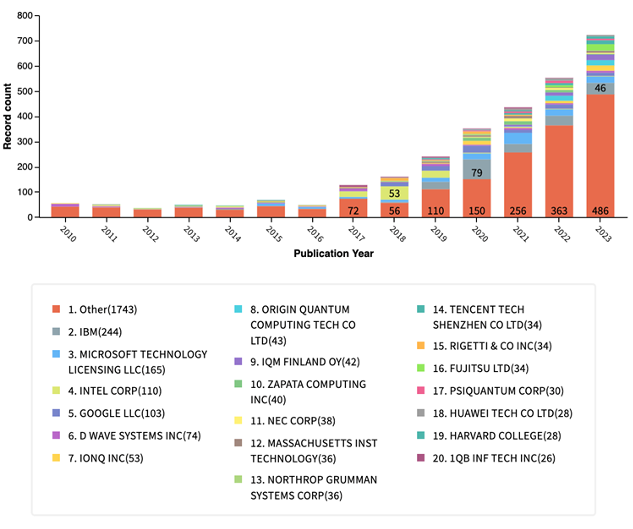

We compared the patent trend found using a keyword search with that from a search on the relevant classification code. Figure 3 shows numbers of issued quantum computing-related patents for all entities (top) and for the top 10 patent owners (bottom) based on a search of the classification code “G06N 10”. The total number of issued patents is larger than the total identified using our keyword-based methodology, which may be due to false positives or the inclusion of less relevant patents versus the keyword search approach. Nevertheless, the trends are similar and many of the top patent owners are the same using both methods.

Figure 2. Quantum computing PCT applications filed in 2010 through 2023 by filer. The figure on the top shows the top 19 PCT filers with all others grouped together. The figure on the bottom shows just the top 10 PCT filers.

Figure 3. Quantum computing patents issued worldwide in 2010 through 2023 by year of publication with classification code G06N 10. The figure on the top shows the top 19 patent owners with all others grouped together. The figure on the bottom shows just the top 10 patent owners.

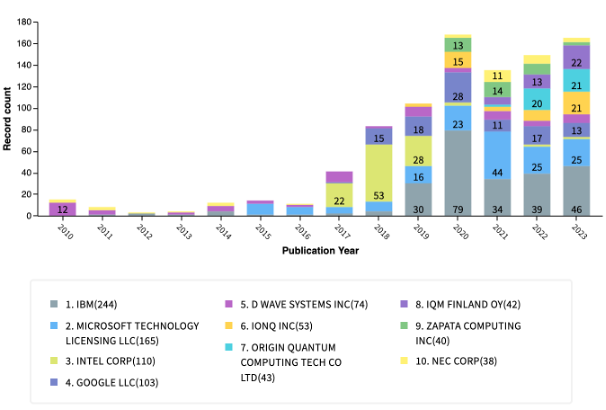

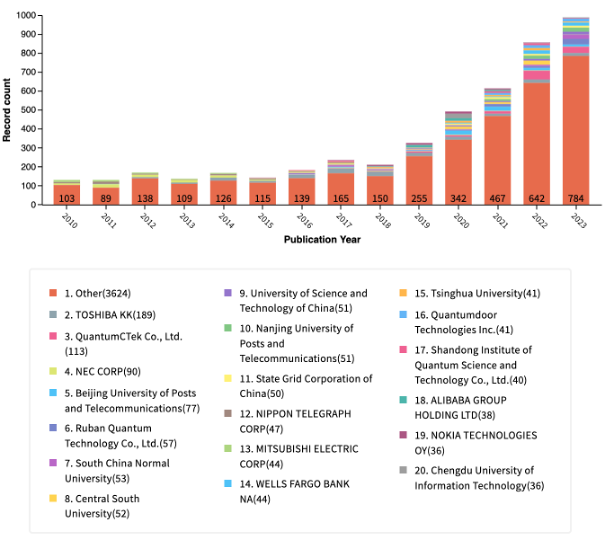

The number of issued quantum communication patents based on our keyword search is also growing year over year (Figure 4). The list of top patent owners includes more Chinese companies, which is consistent with reports on China’s emphasis on quantum communications R&D. The fraction of the total represented by “other” is larger for quantum communications than for quantum computing, suggesting even greater diversity of innovators in the communications space or possibly a larger rate of “false positives” in the keyword search results. Compared to 2022, the top four companies are the same, but their relative order has changed with the second and third positions being swapped.

Figure 4. Quantum communications patents issued worldwide in 2010 through 2023 by year of publication. The figure on the top shows the top 19 patent owners with all others grouped together. The figure on the bottom shows just the top 10 patent owners.

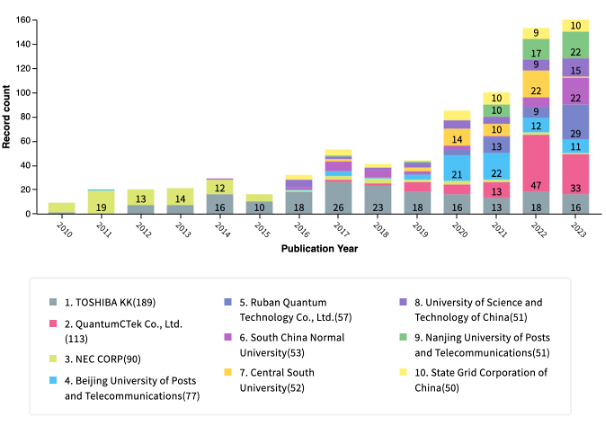

The trend in the number of Patent Cooperation Treaty (PCT) applications related to quantum communications is shown in Figure 5. The total numbers are smaller and therefore the trends tend to be somewhat noisier but are increasing over time.

Figure 5. Quantum communications PCT applications filed in 2010 through 2023 by filer. The figure on the top shows the top 19 PCT filers with all others grouped together. The figure on the bottom shows just the top 10 PCT filers.

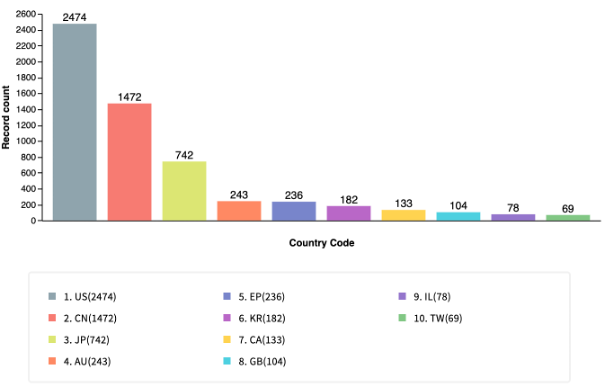

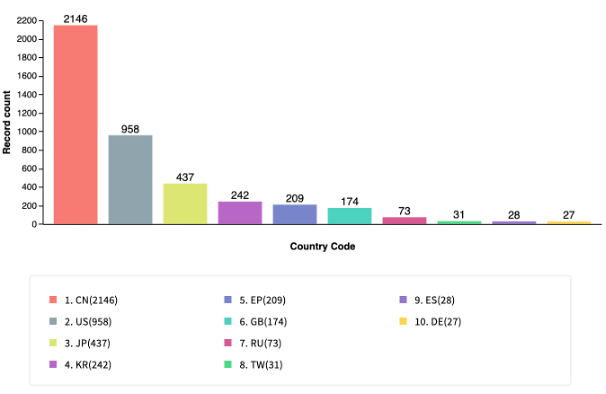

Where in the world inventions are patented is an indicator of where the technology will be manufactured, used or sold. Figure 6 shows the number of quantum computing patents (top) and quantum communications patents (bottom) issued by patent offices around the world. The U.S. patent office has issued the most quantum computing patents and China is second whereas the Chinese patent office has issued the most quantum communications patents followed by the United States. In both cases, the Japanese patent office is third. The Australian and European patent offices are close to each other as the fourth and fifth, respectively, in computing; and the Korean and European patent offices are close to each other as the fourth and fifth, respectively, in communications.

Figure 6. Patent filings during the period from 2010 through 2023 by patent office location. The figure on the top shows the top 10 patent offices for quantum computing patents. The figure on the bottom shows the top 10 patent offices for quantum communications patents.

We compare our results to four other reports on quantum patent trends.

Reports (1) and (2) show a sharp rise starting around 2013 while (3) indicates a more gradual climb starting in approximately 2015. This may reflect the different methodologies used with (1) and (2) including classification codes and (3) using only keywords. Another difference is the dates used, with (1) using priority year (filing date of earliest family member), and (2) and (3) using publication date.

All three reports show growth in the number of patents, though report (2) covers only quantum computing while the others cover all quantum technologies.

For a more detailed comparison of trends across countries and companies, we look at results from European Quantum Industry Consortium (QuIC) report published in January 2024. The QuIC report covers all three of the key technology areas: computing, communication, and sensing, but here we compare results for quantum computing and communication. The quantum computing searches were based on the classification code (G06N-010) for quantum computing, and the quantum communication searches were based on a combination of selected classification codes and keyword searches. All searches were for patent families, where the individual patents in a given family generally contain closely related claimed subject matter since they contain similar or identical description and figures. There are six different charts from the report that can be compared to specific results from our keyword-only searches.

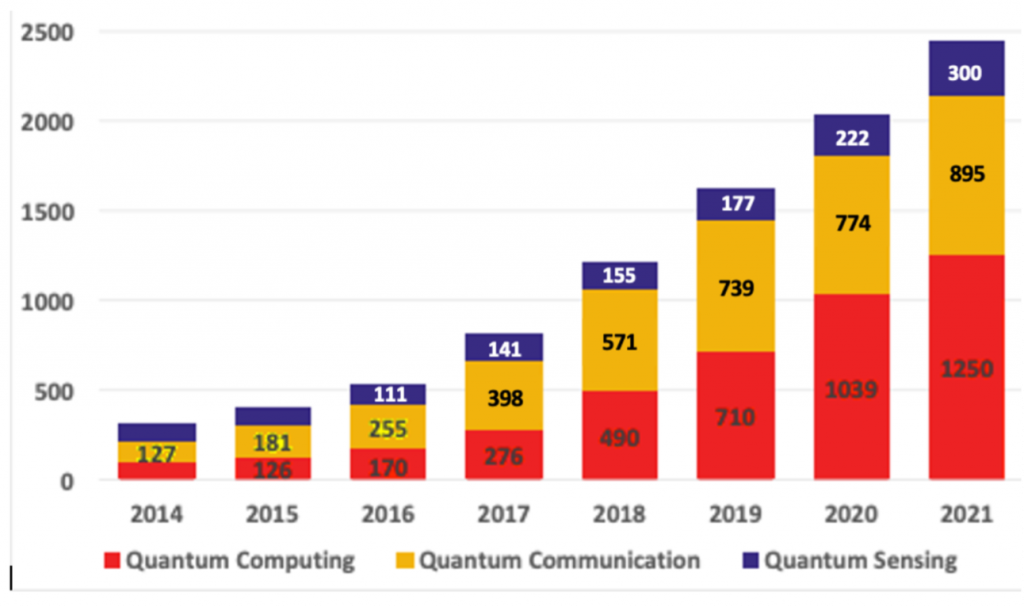

Consistent with all of the reports, results from the QuIC report (Figure 8) shows a steady increase in patents related to quantum computing and quantum communications since 2014.

Figure 8. International patent activity by sector in 2014 through 2021. (European Quantum Industry Consortium, 2024)

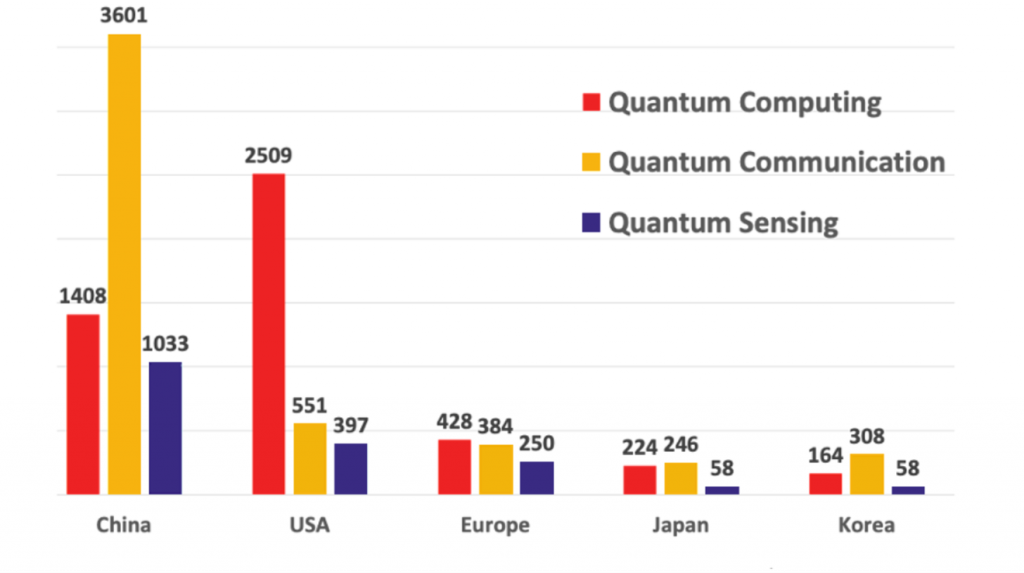

QuIC analysis of patent families for different countries/regions are shown in Figure 9. It appears that these numbers are for the country of origin of the patent filers instead of patent office locations, but the country that is leading in quantum communications (China) and in quantum computing (United States) are the same.

Figure 9. Number of patent families by sector and by country/region according to priority date. (European Quantum Industry Consortium, 2024)

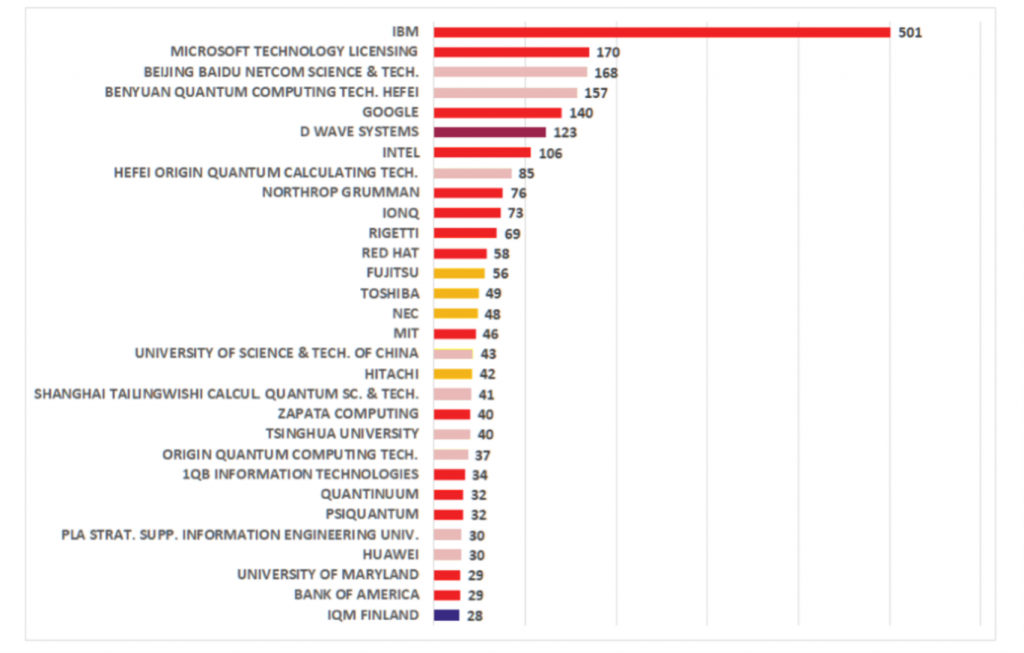

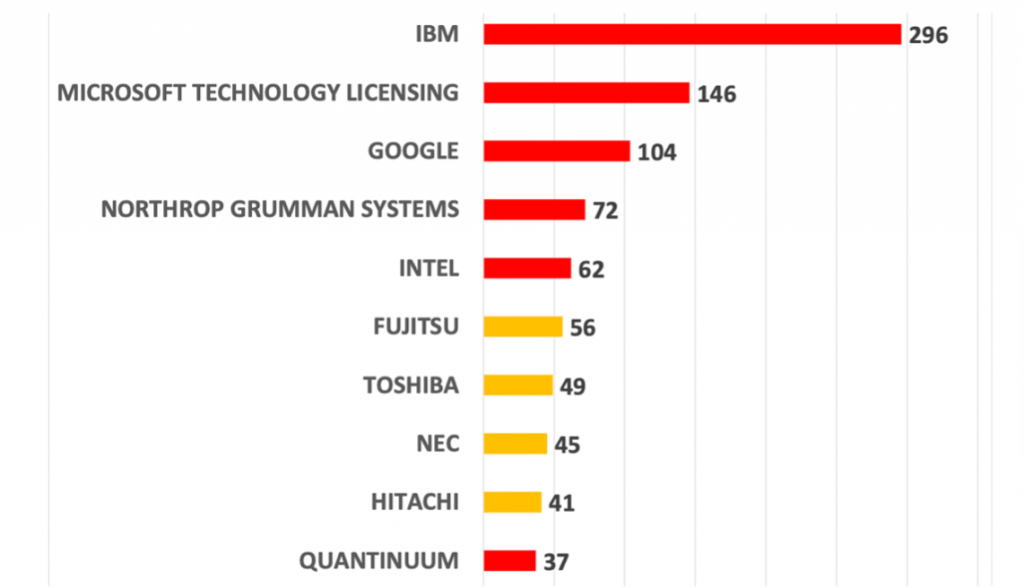

QuIC also ranked the owners with the largest number of quantum computing patent families (see Figure 10). Despite the differences in search strategies, the results are largely similar to those in our study (see Figure 1). Entities appearing in the top 10 of both lists, namely: IBM, Google, D Wave Systems, Microsoft, Beijing Baidu Netcom Sci & Tech, Northrop Grumman, Intel, IonQ, and Hefei Origin Quantum.

Figure 10. Main assignees in quantum computing ranked by number of alive patent families. (European Quantum Industry Consortium, 2024)

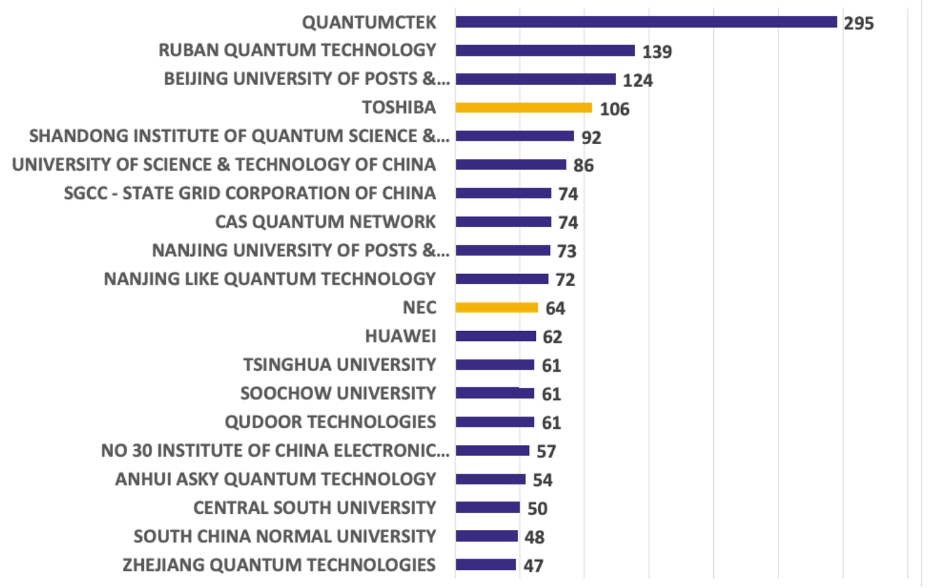

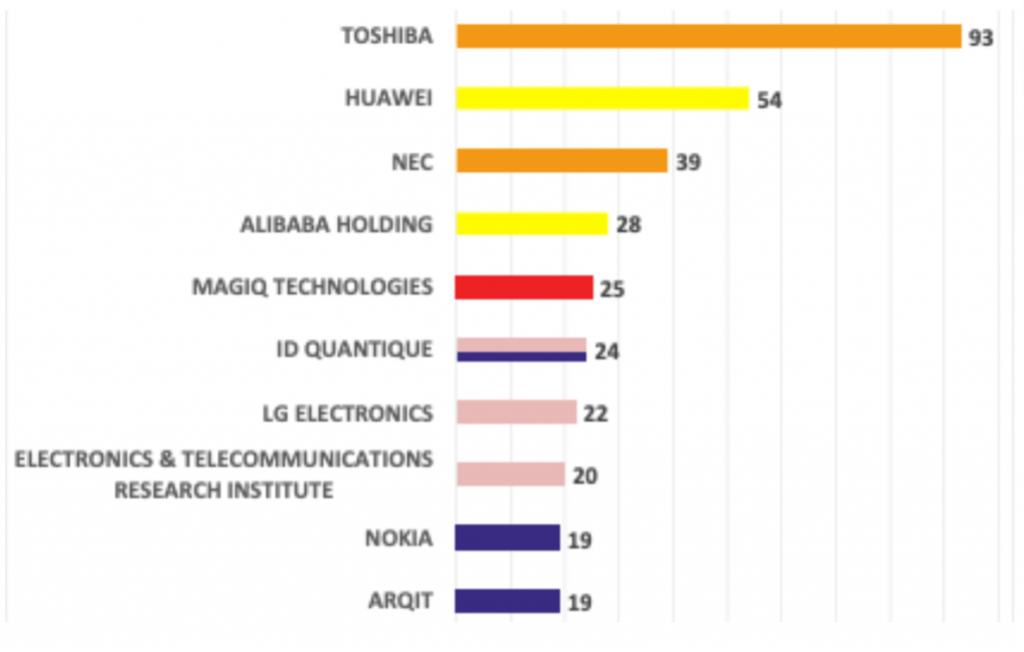

QuIC also ranked the owners with the largest number of quantum communication patent families (Figure 11). As for quantum computing, despite the differences in search strategies, there are similarities to the top entities in our study (see Figure 4). Entities appearing in the top 10 of both lists, namely: Toshiba, Quantum CTek, Beijing Univ of Posts & Telecom, Ruban Quantum Tech, Univ of Sci & Tech of China, Nanjing University of Posts & Telecom, and State Grid Corp of China.

Figure 11. Main assignees in quantum communications ranked by number of alive patent families. (European Quantum Industry Consortium, 2024)

QuIC analyzed the owners of international patent families related to quantum computing filings in patent offices of multiple countries (Figure 12), which is a similar indicator as the number of quantum computing PCT applications shown in Figure 2, though not necessarily identical since foreign patents can be filed directly without going through a PCT, and some PCTs are abandoned without foreign patents being filed. There are some (though fewer) entities appearing in the top 10 of both lists, namely: IBM, Microsoft, Intel, Google, and NEC.

Figure 12. Top 10 assignees of quantum computing international patent families. (European Quantum Industry Consortium, 2024)

QuIC analyzed the owners of international patent families related to quantum communication filings in patent offices of multiple countries (Figure 13). Compared to our analysis of PCT filings related to quantum communications (see Figure 5), there are several entities appearing in the top 10 of both lists, namely: Toshiba, Huawei, Arqit, LG Electronics, Alibaba, and NEC.

Figure 13. Top 10 assignees of quantum computing international patent families. (European Quantum Industry Consortium, 2024)

The patent trends in quantum computing and quantum communications show continued growth in 2023. The general rise in patent activity tracks with growing R&D investments in the public and private sectors, although patents are generally a trailing indicator of innovation, behind investments and performance of R&D. While VC funding has dipped recently, public spending has grown [6] and corporate investments by large companies in the space has continued apace. In the future, we might expect to see a growth in the number of patents filed by universities and other government-funded research institutions. As markets develop worldwide, it will be interesting to see if the breakdown of patents issued by country also evolves.

[1] See https://quantumconsortium.org/blog/quantum-patent-trends-update-2022/ , https://quantumconsortium.org/blog/quantum-patents-part-2/ , and https://quantumconsortium.org/blog/trends-in-quantum-computing-patents/

[2] M. Kurek (2020) Quantum Technologies: Patents, Publication and Investments Landscapes. Accessed on 10/8/2024 https://zenodo.org/records/7473989

[3] European Patent Office (2023) Quantum computing insight report. Accessed on 10/8/2024 https://link.epo.org/web/epo_patent_insight_report-quantum_computing_en.pdf

[4] M. Aboy et al. (2022) Mapping the patent landscape of quantum technologies: Patenting trends, innovation and policy implications, IIC 53:853-882. Accessed on 10/8/2024 https://link.springer.com/article/10.1007/s40319-022-01209-3

[5] European Quantum Industry Consortium (2024) A portrait of the global patent landscape in quantum technologies. Accessed on 10/8/2024 https://www.euroquic.org/wp-content/uploads/2024/03/QuIC-White-Paper-IPT-January-2024.pdf

[6] E.g. https://www.mckinsey.com/capabilities/mckinsey-digital/our-insights/steady-progress-in-approaching-the-quantum-advantage