Quantum patents part 2: quantum communications

by Elliott Mason, PhD

My prior article looked at trends in quantum computing patents. This second installment focuses on patent trends for quantum communications over the past decade, 2011–2020. The data detail patents and patent applications reported by patent offices worldwide by publication date. Patent trends for quantum communications are generally similar to those for quantum computing, although with some key distinctions on which I elaborate below. For those who are interested in specific advances, I end with my personal selection of an interesting “solution of the day.”

Approach

My analysis is based on publicly available patent data hosted by Derwent Innovation. Data on the total number of patents and top patent filers are shown. In addition, the volume of patents by country in which the patents were filed are presented, an indication of where innovation is taking place and where inventors believe markets will develop. Also shown are the trends in Patent Cooperation Treaty (PCT) applications, an indication of intent to file in multiple countries or regions and of the belief that manufacture and sale of products will be geographically distributed and sufficient to justify the considerable cost of seeking international patent protection. While careful readers may notice some “glitches” in the charts below (generated using Derwent Innovation); I nevertheless believe the charts provide accurate relative trends for the constructed queries. For further details on how I compiled the data and generated these charts, interested readers can contact me at mason@youngbasile.com.

Quantum communications trends

Quantum communications patent activity, much of which is for quantum key distribution (QKD) technologies, is dominated by innovators headquartered in Japan and China, which hold most of the top 10 spots in terms of the number of patents granted.

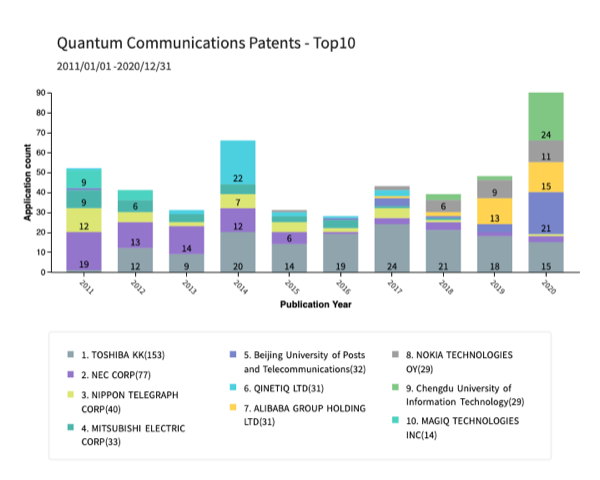

Top producers of quantum communications patents are headquartered outside the US, and the long-term trend in patent production is not clear. Fig. 1 shows the number of quantum communications related patent applications (only those eventually awarded as patents) for each of the top 10 entities (listed as the “assignee” or owner of the patent) over the past decade. Toshiba holds about a third of the total patents awarded to the top 10 patent recipients, with a relatively steady number over the last 9 years. Others have lower numbers in recent years (e.g., including second place NEC Corp.), and others have a recent increase (e.g., Alibaba, Chengdu University of Information Technology, and Beijing University of Posts and Telecommunications). The total number of patents awarded to these companies in a given year increased in 2020, but has not shown the same steady recent upward trend as for quantum computing (see part 1). In addition to Japan and China—the top 2 locations for the top 10 entities—other members of the top 10 are headquartered in the UK (QinetiQ) and Finland (Nokia Technologies).

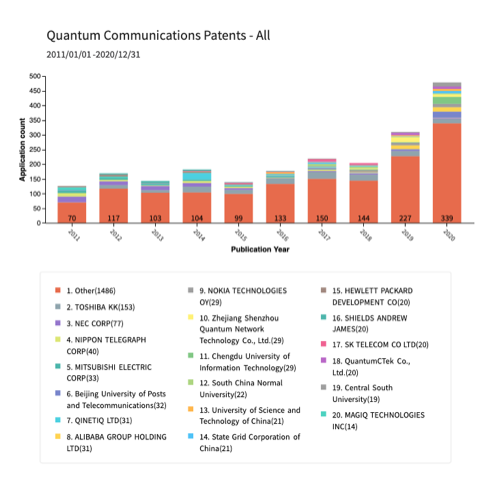

Quantum communications patent applications over the past decade are generally less concentrated by entity than for quantum computing. Fig. 2 shows results of the same search as in Fig. 1 but for all entities. Patent recipients with fewer patents than the top 19 are grouped together in an “Other” category. As a group, Other recipients were collectively awarded the largest portion of the total number of patents since 2011, indicating the diffuse sources of innovation in quantum communications. This feature was true for quantum computing, but is even more pronounced for quantum communications.

Fig. 1

Fig. 1

Fig. 2

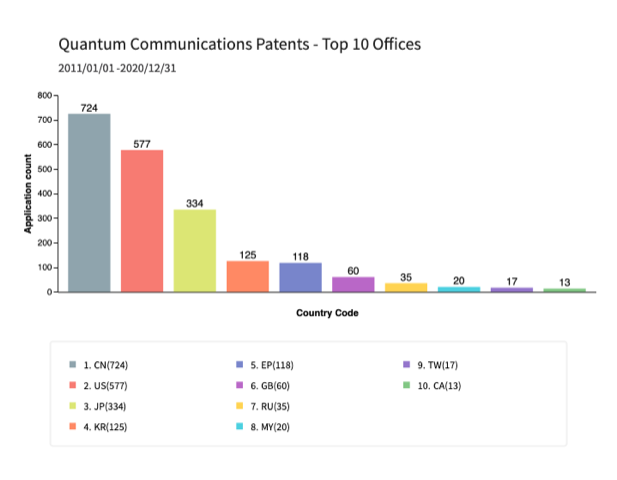

Patent filings suggest the strongest markets are anticipated in China (CN), the US, and Japan (JP). Fig. 3 shows the top ten patent offices by number of quantum communications related patent applications granted since 2011. Note that these data are for the country in which the patent application is being filed, not the location of the entity that is filing the application. The China National Intellectual Property Administration has awarded the largest number of patents, followed by the US Patent and Trademark Office and the Japan Patent Office. This is a reflection of both the level of activity and the perception of where markets are likely to emerge.

Fig. 3

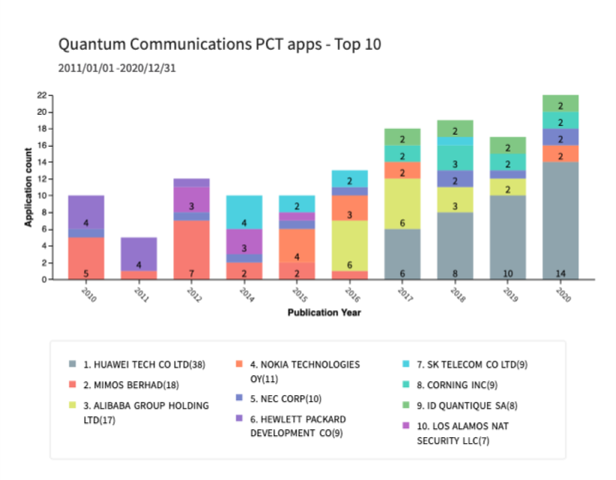

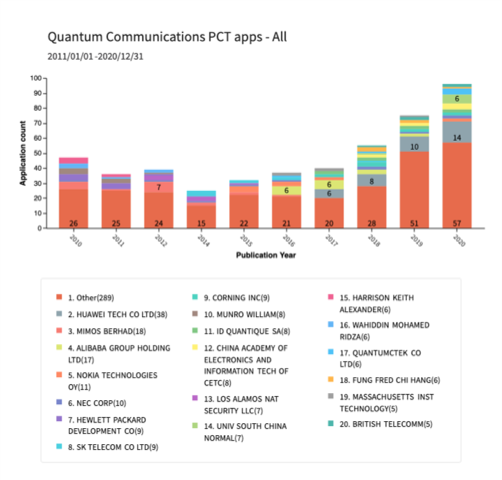

Interest in securing intellectual property protection across countries and regions remains strong. Figs. 4 and 5 show trends in international filings under the Patent Cooperation Treaty, or PCT filings, an indication of the interest in securing intellectual property protection in multiple countries and regions. Fig. 4 shows the number of PCT patent applications related to quantum communications filed by the top 10 entities by publication year. While there is a slight upward tick in the total number of PCT applications published, it is difficult to identify a definitive trend for the top 10 due to the relatively small numbers. As for patent recipients shown in Fig. 2, Fig. 5 shows that the Other category also generally has the largest number of PCT applications.

Fig. 4

Fig. 5

Compared to the trend in quantum computing patent activity summarized in part 1, the increase in the number of PCT applications filed (over all filers) in recent years is more modest. But, there does seem to be an upward trend, at least over the past 7 years.

I plan to update these patent trends for quantum computing, quantum communications, and potentially other quantum use cases.

Solution of the day

In this post, my pick for an interesting problem being solved, as revealed in a recent patent application, is related to QKD. Since this blog series will generally avoid revealing specific legal claims being pursued by any particular entity, I will describe the solution in terms of the general problem being addressed.

One recently published quantum communications patent application provides solutions for situations that can occur when QKD is performed between one primary node and each of multiple secondary nodes using the BB84 protocol. There may be a need for the primary node to asymmetrically establish keys at a different rate with each secondary node. Optical switching techniques can be used to control the different QKD channels in such a multi-receiver QKD scenario.

While I have kept the specific patent application anonymous in this post, interested readers can contact me for discussion on this or any other topic that is publicly disclosed and not client confidential (mason@youngbasile.com).

Elliott Mason is a patent agent at the law firm Young Basile, has a PhD in nonlinear and quantum optics, and was an experimentalist on a team at MIT working to demonstrate enabling technologies for long-distance quantum teleportation. The views expressed in this blog entry are those of the author, and do not constitute a legal opinion and do not necessarily reflect the official policy or position of the QED-C, SRI International, or Young Basile. Any content provided is not intended to malign any country, ethnic group, company, organization, or individual.